Within the stupefying scene of home financing, finding the proper contract can feel associated to tackling a complex perplex. In the midst of the horde choices accessible, affirming advances have risen as a well known choice for numerous imminent homebuyers. In this comprehensive direct, we’ll unwind the puzzles of affirming advances, giving a point by point investigation of what they involve, how they work, and whether they’re the correct fit for your homeownership travel.

Understanding Affirming Credits:

What Are They?

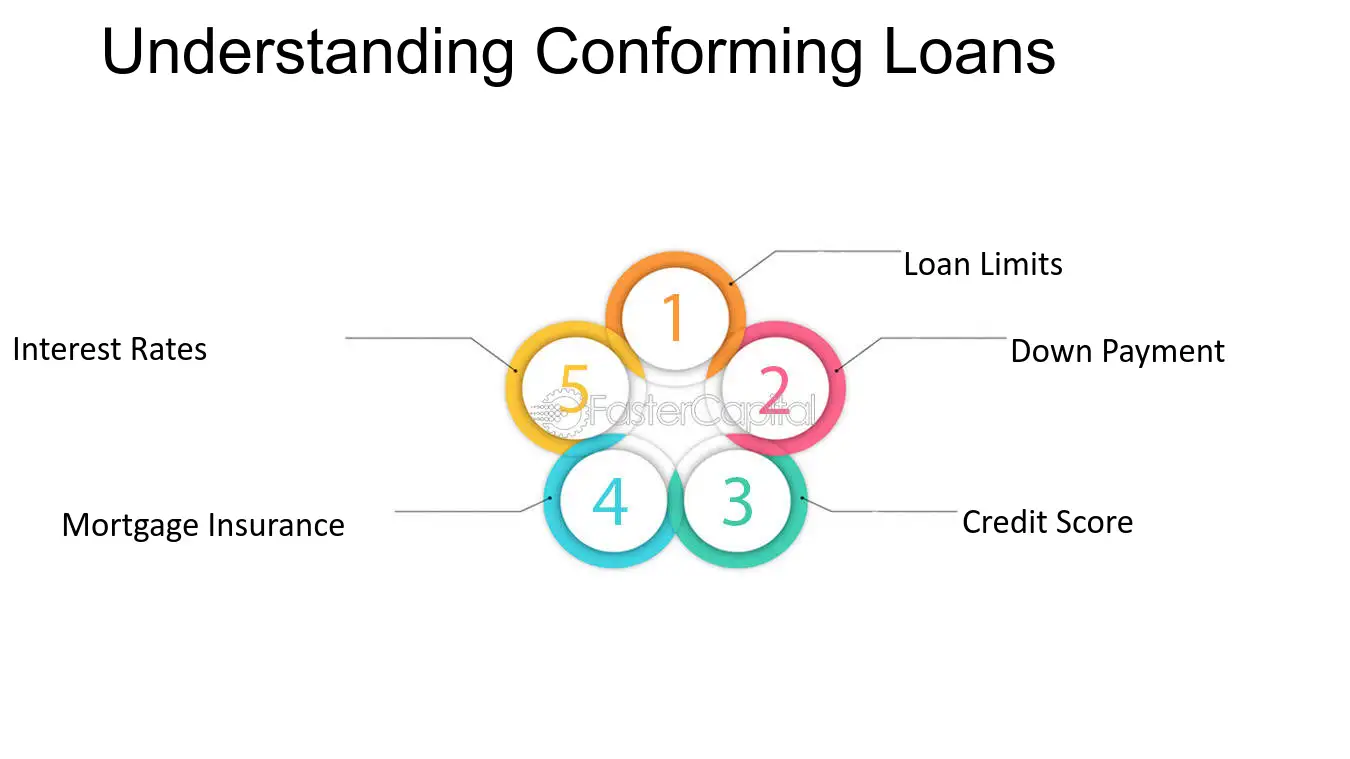

Let’s start at the starting. A affirming credit, moreover alluded to as a adjusting advance, may be a contract credit that follows to the rules set by government-sponsored endeavors (GSEs) like Fannie Mae and Freddie Mac. These rules envelop components such as advance estimate, credit score, debt-to-income proportion, and property sort. Basically, affirming credits meet the criteria built up by GSEs, making them more engaging to both moneylenders and borrowers.

The Benefits of Affirming Credits

Why might one consider a affirming credit over other contract alternatives? The essential appeal lies within the favorable intrigued rates and terms frequently related with these credits. Since affirming credits follow to GSE rules, banks see them as lower risk, resulting in lower intrigued rates for borrowers. Additionally, confirming credits by and large require littler down installments compared to non-conforming advances, in this manner upgrading openness to homeownership.

Sorts of Affirming Credits

Affirming credits come in different shapes, each custom-made to meet the assorted needs of borrowers:

Fixed-Rate Affirming Advances:

These credits highlight a settled intrigued rate for the term of the advance term, giving borrowers with steadiness and consistency in their month to month installments.

Adjustable-Rate Affirming Advances:

With these credits, the intrigued rate vacillates based on market conditions, typically beginning lower than fixed-rate advances but subject to alteration over time.

Enormous Affirming Advances:

In certain high-cost ranges, borrowers may require a credit sum surpassing the standard affirming advance restrain. Enormous affirming credits bridge this hole, advertising financing for bigger credit sums whereas still following to GSE rules.

How Do Affirming Credits Work?

Digging more profound into the mechanics, let’s investigate how affirming advances work. When a borrower applies for a affirming advance, the moneylender evaluates their monetary wellbeing and financial soundness. On the off chance that affirmed, the moneylender begins the loan and may pick to offer it to a GSE like Fannie Mae or Freddie Mac. By offering the credit, the bank liberates up capital to finance extra credits, in this manner supporting liquidity within the contract showcase.

Qualifying for a Affirming Credit

Qualifying for a confirming credit mirrors the method for other contract sorts. Loan specialists consider variables such as credit score, pay steadiness, work history, debt-to-income proportion, and down installment sum when assessing a borrower’s qualification. Whereas affirming advances offer alluring terms, borrowers must still fulfill certain criteria to secure endorsement.

The Application Handle

Exploring the application handle for a affirming credit is moderately clear, though subject to slight varieties among loan specialists. Borrowers regularly outfit documentation such as pay stubs, assess returns, bank articulations, and resource records to back their application. Concurrently, banks conduct a intensive credit appraisal to gage the borrower’s financial soundness. Upon accommodation, the moneylender audits the documentation and renders a decision on advance approval.

Choosing the Proper Loan specialist

Selecting a loan specialist for a affirming advance requests cautious thought. Whereas conventional banks and credit unions serve as routine choices, borrowers can also investigate online banks and contract brokers. Critical factors to weigh incorporate intrigued rates, advance terms, expenses, and the lender’s notoriety for client benefit.

Overseeing Your Affirming Advance

Upon securing endorsement for a affirming credit, dependable administration is vital to maintaining homeownership. This involves making opportune month to month payments, monitoring intrigued rate vacillations, and remaining careful with respect to changes in the contract scene. Ought to monetary challenges emerge, incite communication with the moneylender is basic to investigate potential arrangements.

May be a Affirming Loan Right for You?

Eventually, the reasonableness of a affirming advance pivots on person budgetary circumstances and goals. Whereas these credits offer alluring intrigued rates and terms, they may not adjust with everyone’s needs. Planned borrowers ought to carefully assess components like credit score, wage solidness, down installment capacity, and long-term homeownership goals to decide the most excellent course of activity.

The Long run of Affirming Advances

Looking ahead, affirming advances are balanced to hold their notoriety in the contract showcase. Be that as it may, advancing financial conditions, lodging patterns, and administrative flow may impact the accessibility and terms of these credits. As such, borrowers ought to stay careful, staying abreast of industry advancements to adjust their strategies accordingly.

Conclusion

In conclusion, affirming credits show an alluring road for realizing homeownership dreams with favorable terms and rates. By adhering to GSE rules, these credits offer steadiness, reasonableness, and openness to a wide range of borrowers. Whether you’re embarking on your lady domestic buy or mulling over a refinancing endeavor, comprehending the subtleties of affirming advances engages you to create educated choices and set out on the path to homeownership with certainty.